|

25 June - 01 July

2016

|

|

|

|

|

From

the CEO OF EMIS

Living in the UK, it is easy to get caught up in the ongoing political fallout from the country’s decision to leave the European Union. There is a strange fascination in seeing political careers unexpectedly wrecked and the very existence of once-powerful parties threatened. So it comes as some relief that my job involves looking at markets where Brexit is an issue but not the dominant one.

|

|

Emerging market currencies naturally came under immediate pressure last week as investors sought refuge in developed currencies. But as the initial shock dissipated, we saw a rebound in EM currencies and assets. Now it seems certain that a consequence of Brexit will be a further delay to US Fed rate rises. This is massively helpful to the prospects of emerging markets where so much debt is denominated in US Dollars. As I mentioned in previous weeks, the long-term impact on emerging markets from Brexit will be patchy. Eastern Europe remains at greatest risk while Latin American and Asian economies are relatively immune and may even benefit.

Clearly, the notion that developed markets represent safety and emerging markets equate to risk needs reassessment. Supposedly perilous emerging markets must be looking on in bemusement as the world’s fifth largest economy has its credit rating downgraded, its politics dissolve into chaos and its people split down the middle in terms of its future direction. Dutch Prime Minister Paul Rutte said this week that the UK had ‘collapsed politically, monetarily, constitutionally and economically’. At this juncture, it is hard to disagree with him.

Guy Dunn

Chief Executive

Officer

Here are a few articles I came across on the EMIS service that show the uneven effects of Brexit:

|

|

|

|

|

|

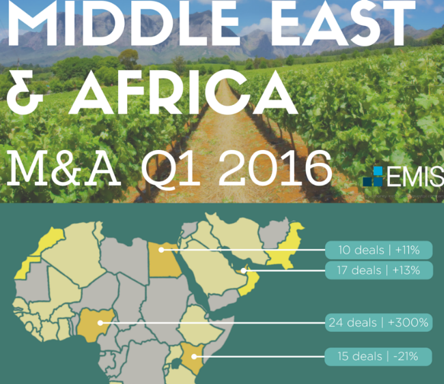

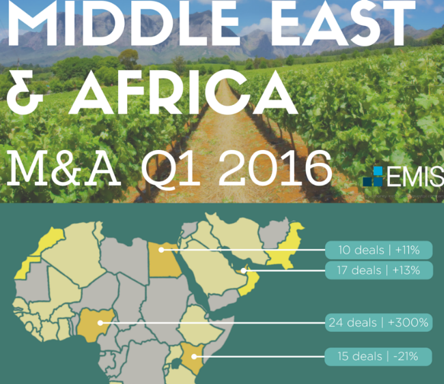

Infographic

of the week

M&A activity in South Africa was low in the first quarter of 2016, with only several deals above USD 100mn. The local economy is set to grow by only 0.6% in 2016, and the overall outlook seems uncertain due to droughts, high inflation and political unrest.

|

|

EMIS

Insights and reports

Here

are two of our own exclusive industry insights from EMIS' team of

highly experienced, locally-based analysts. EMIS Insights deliver the

most relevant industry news, data and research from over 25 sectors in

21 countries.

TURKEY AUTOMOTIVE: YEAR OF RECORDS

The production of passenger cars and commercial vehicles in Turkey rose by 16% y/y to an all-time high of 1.36 million units and exports of motor vehicles also surpassed one million units in 2015.

|

MEXICO TOURISM: MEXICO IS ALWAYS A GOOD IDEA

Mexico was the world’s 10th most visited country in 2014, receiving a record high 29.3mn international visitors, up 21.1% y/y, and ranked 22nd in terms of international tourism receipts .

|

|

|

|

Weekly

News summary

Below

are the most read articles in the past week on EMIS

Perspectives, our daily blog of

emerging market news and insights.

|

|