December 2025 Top M&A Deals in Emerging Markets by Region

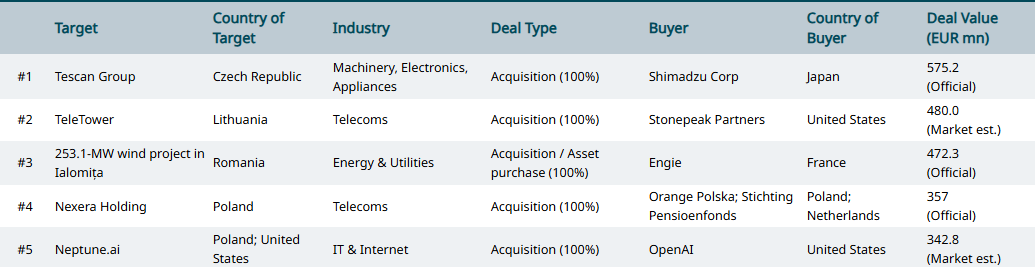

Eastern Europe

Japanese precision instrument manufacturer Shimadzu Corporation has agreed to acquire Czech electron microscopy specialist Tescan Group from U.S.-based private equity firm The Carlyle Group for USD 678mn. The acquisition marks Shimadzu’s strategic entry into the electron microscopy segment, enabling it to expand Tescan’s reach across Asia using Shimadzu’s manufacturing and sales networks.

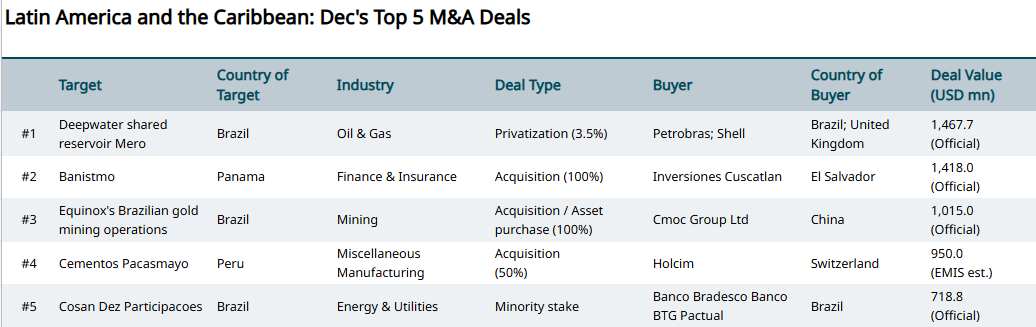

Latin America and the Caribbean

Brazilian oil giant Petrobras, in consortium with Shell, is acquiring a 3.5% stake in the Mero shared reservoir from the Federal Government of Brazil for BRL 7.7bn (USD 1.4bn). The stake was secured through the Non-Contracted Areas Auction. The consortium structure gives Petrobras 80% and Shell 20% participation. The deal aligns with Petrobras’ strategy to reinforce its reserve base in high-productivity pre-salt assets, with Mero being a key long-term growth contributor.

Emerging Asia

Chinese state-controlled energy giant China Shenhua Energy has announced the acquisition of stakes in 12 subsidiaries from its parent company, National Energy Investment Group, in a sweeping deal valued at CNY 128.7bn (USD 18.3bn). The acquisition addresses horizontal competition within the group and reinforces Shenhua’s integrated model.